Annual compliance typically refers to the various mandatory tasks, filings, reports, and procedures that a business or organization must complete each year to ensure they are following the laws, regulations, and standards relevant to their industry or sector. This can include financial audits, tax filings, regulatory reports, renewals of licenses and permits, and adherence to environmental, health, and safety regulations, among others. The specific requirements for annual compliance can vary widely depending on the country, the type of business, the industry sector, and even local laws.

ANNUAL COMPLIANCE OF LLP

LLP: DEFINITION, CHARACTERISTICS AND OBJECTIVES

A Limited Liability Partnership (LLP) is a legal entity that

combines

features of partnerships and corporations. Specifically, it provides its

partners with limited liability, meaning their personal assets are generally

protected from the debts and liabilities of the LLP.

At the same time, it allows the business operation to benefit from the

flexibility of a partnership, particularly in terms of management and the

distribution of profits among partners.

LLPs are favored in professional fields like law, accounting, and

consulting, where they offer a structure that accommodates professional

practice while mitigating personal risk. The exact regulations governing

LLPs, including formation, liability extent, and tax treatment, vary by

jurisdiction.

CHARACTERISTICS:-

1. Legal Entity Status: An LLP is a separate legal

entity from its

partners. This means it can enter into contracts, own property, and be

involved in legal proceedings in its own name.

2.No Maximum Number of Partners: Generally, LLPs do not have a

restriction on the maximum number of partners, which is advantageous

for businesses looking to expand their partnership base.

3. Continuity of Existence: An LLP can continue to exist beyond the

change in partners, whether through death, withdrawal, or addition of

new partners, ensuring business continuity.

4. Limited Liability: One of the main features of an LLP is that it

offers its partners protection from some or all of the debts of the LLP,

depending on the jurisdiction. This means that, unlike in a traditional

partnership, the personal assets of the partners are generally protected

from business liabilities.

5. Taxation: Typically, LLPs enjoy a pass-through taxation status,

meaning the entity itself is not taxed on its profits. Instead, profits and

losses

are passed through to the individual partners, who then report this income

on their personal tax returns. This avoids the double taxation

commonly associated with corporations.

6. Professional Use: In some jurisdictions, LLPs are specifically

designed for and restricted to professionals, such as lawyers, accountants,

and architects, providing a way to work collaboratively with limited

liability.

OBJECTIVES:

Limited Liability Protection: To provide partners with

protection against personal liability for business debts and

obligations, safeguarding

personal assets except in cases of fraud or wrongful acts.

Tax Efficiency: To offer a tax-efficient structure through

pass-through taxation, where income is taxed at the individual partner

level,

avoiding the double taxation commonly associated with corporations.

Regulatory Lightness: To reduce the regulatory burden on

businesses, especially professional services firms, by offering a

simpler

compliance and administrative framework compared to corporations.

Attractiveness to Professionals: CTo provide a legal structure

that is particularly attractive to professionals (such as lawyers,

accountants,

and consultants) who wish to retain the advantages of partnership while

enjoying limited liability.

Investment and Funding Flexibility: Although not as

equity-friendly as corporations, LLPs offer mechanisms for bringing in

new partners or

investors, providing some flexibility for growth and expansion.

Customization:To provide a framework that allows for

customization of the partnership agreement, enabling partners to tailor

the operation,

management, and profit-sharing arrangements to their specific needs.

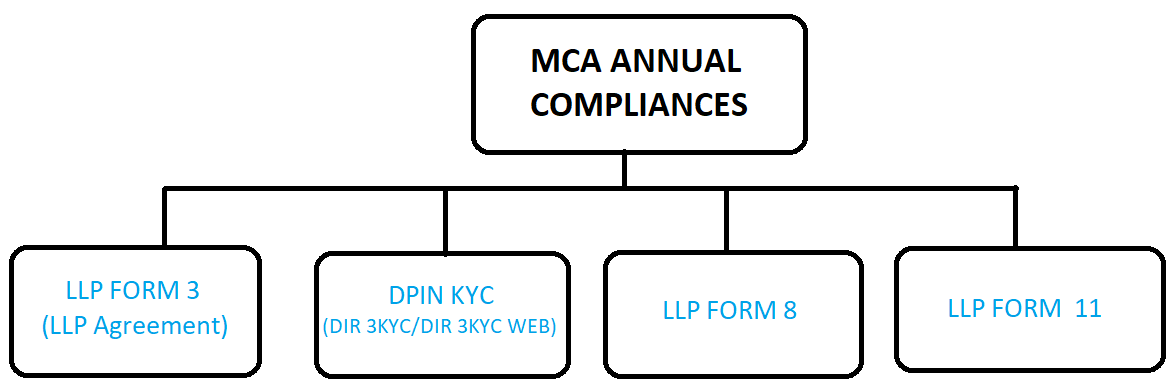

MCA annual compliances for private limited companies

The MCA, or Ministry of Corporate Affairs, is a government agency in India

that oversees corporate regulation and administration. The MCA

is responsible for regulating and administering corporate and related

affairs in India through the Companies Act, 2013, the Limited Liability

Partnership Act, 2008, and other allied Acts and rules & regulations framed

mainly for regulating the functioning of the corporate sector in

accordance with law. Its activities include:

1. Incorporation of companies and LLPs (Limited Liability Partnerships).

2. Ensuring companies and LLPs comply with statutory requirements.

3. Providing public access to corporate information.

4. Protecting investors and offering remedies for grievances.

5. Overseeing corporate governance through regulatory measures

LLP FORM 3

LLP Form 3 is a document used in India for filing information about the LLP

Agreement to the Ministry of Corporate Affairs (MCA).

The LLP Agreement is a crucial document for any Limited Liability

Partnership as it outlines the rights, duties, and obligations of the

partners

in relation to one another and in relation to the LLP.

* Purpose of filling: Form 3 is specifically designed for the filing

of the LLP Agreement and changes therein with the Registrar of LLPs.

This agreement shows the structure of the LLP like- profit sharing ratio,

capital contribution by each partner, rules and regulations of the

LLP, etc.

* Time: This form must be filled within the 30 days from the date of

registration of LLP in MCA.

* Fees: The fees of the LLP form 3 depends on the total capital

contribution by the partners as below:

| CAPITAL CONTRIBUTION | FEES |

|---|---|

| Less than 1,00,000 | 50 |

| 1,00,001-5,00,000 | 100 |

| 5,00,001-10,00,000 | 150 |

| 10,00,001-25,00,000 | 200 |

| 25,00,001-1,00,00,000 | 400 |

| Above 1,00,00,000 | 600 |

* Late fees: The late fees depends on the delay in terms of no. of days in filling the form when 30 days’ time period has been lapsed.

| No. of days | Small LLP* | Other than small LLP |

|---|---|---|

| Within 15 days | 1 time the normal fees | 1 times the normal fees |

| More than 15 days - up to 30 days | 2 times the normal fees | 4 times the normal fees |

| More than 30 days - up to 60 days | 4 times the normal fees | 8 times the normal fees |

| More than 60 days - up to 90 days | 6 times the normal fees | 12 times the normal fees |

| More than 90 days - up to 180 days | 10 times the normal fees | 20 times the normal fees |

| More than 180 days – up to 360 days | 15 times the normal fees | 30 times the normal fees |

| More than 360 days | 25 times the normal fees | 50 times the normal fees |

*Small LLP- “Small limited liability partnership” means a limited

liability partnership -

(i) The contribution of which, does not exceed `25 lakh or such higher

amount, not exceeding `5 crore, as may be prescribed;

and

(ii) The turnover of which, as per the Statement of Accounts and Solvency

for the immediately preceding financial year, does not

exceed forty lakh rupees or such higher amount, not exceeding fifty crore

rupees, as may be prescribed; or

(iii) Which meets such other requirements as may be prescribed, and

fulfils such terms and conditions as may be prescribed –

section 2(1)(ta) of LLP Act, inserted vide LLP Amendment Act, 2021 w.e.f.

1-4-2022.

* All late fees will be charged along with the normal fees.

Penalty in case the LLP Form 3 not filled within the delayed period also: the ROC will strike off the name of the LLP.

DPIN KYC (FORM DIR 3KYC)

DPIN stands for Designated Partner Identification Number.

It is a unique identification number assigned to individuals who are designated

partners of an LLP.

DPIN is obtained by applying to the Ministry of Corporate Affairs (MCA) through

the LLP registration process or by filing Form DIR-3 for

existing partners of LLPs.

WHO CAN APPLY FOR IT BASED ON THE PRESCRIBED ELIGIBILITY CRITERIA FOR DPIN?

* Residency Status: The designated partners may be Indian or foreign

individuals, at least one of them appointed in an LLP must

be an Indian Resident. The LLP Act defines an Indian Resident for this purpose

as an individual who has stayed in India for more

than 120 days in the previous financial year.

* Age Requirement: Designated Partners must be at least 18 years old at

the time of DPIN application.

* Capacity to Contract: Designated Partners must possess the legal

capacity to enter into contracts. They should not be

disqualified under any law from entering into contractual agreements.

* Sound Mind: Designated Partners must be of sound mind, meaning they

should not be declared legally incompetent or incapable

of managing their affairs.

* Convicted in a Legal Offense: Individuals who have been disqualified by

law from holding the position of Designated Partner due

to any legal proceedings or convictions are ineligible.

* No Insolvency Proceedings: Designated Partners must not be undergoing

any insolvency proceedings or have been declared

insolvent by a court of law.

* Educational Qualifications: While there are no specific educational

qualifications mandated by law, individuals aspiring to

become Designated Partners should ideally possess the requisite knowledge,

skills, and experience relevant to the operations of

the LLP.

DPIN KYC AND ITS PURPOSE

The DPIN KYC process in LLP involves the verification of the identity and credentials of the designated partners by the Ministry of Corporate Affairs (MCA) or the Registrar of Companies (ROC). This process aims to ensure the authenticity of the designated partners and prevent fraudulent activities within LLPs.

* Transparency and Accountability: DPIN KYC promotes transparency within

the LLP by ensuring that the identities of designated

partners are accurately documented and verified. This enhances the credibility

of the LLP and instills confidence among

stakeholders, including investors, creditors, and business partners.

* Prevention of Fraud: By conducting DPIN KYC, the authorities can verify

the authenticity of designated partners, thus reducing

the risk of fraudulent activities within the LLP. Verifying the identities and

backgrounds of designated partners helps in maintaining

the integrity of the LLP structure.

* Regulatory Compliance: The DPIN KYC process ensures compliance with

regulatory requirements mandated by the Ministry of

Corporate Affairs (MCA) in India. It helps verify the identities of designated

partners and ensures that only eligible individuals hold

such positions.

* Time: After 31 st March and before 30 th September every year.

* Fees: There is no fees for DIR 3KYC form.

* Late fees: If form not filled before 30 th September then, after 30 th

September the DPIN get deactivated by the MCA department and fees of

5000 is charged from the director in the form of late fees.

LLP FORM 8 ANNUAL RETURN

In Form 8, the LLP should furnish the information of the financial

transactions within the fiscal year and the position to finish the financial

year.

The LLP should mention:

* Show that the turnover exceeds or less than Rs 40 lakhs.

* Show that the LLP has previously furnished a statement showing the

creation of charges or modification or satisfaction till the

current fiscal year.

* Show that the partners or authorized representatives have opted for

effective handling and responsibility to maintain enough

accounting records and preparation of accounts.

Time: LLP form 8 must be filled before 30 th October every year.

Fees: The fees of LLP form 8 depends totally on the total capital

contribution of the partners.

| CAPITAL CONTRIBUTION | FEES |

|---|---|

| Less than 1,00,000 | 50 |

| 1,00,001-5,00,000 | 100 |

| 5,00,001-10,00,000 | 150 |

| 10,00,001-25,00,000 | 200 |

| 25,00,001-1,00,00,000 | 400 |

| Above 1,00,00,000 | 600 |

* Late fees: The late fees depends on the delay in terms of no. of days in filling the form when 30 days’ time period has been lapsed.

| No. of days | Small LLP* | Other than small LLP |

|---|---|---|

| Within 15 days | 1 time the normal fees | 1 times the normal fees |

| More than 15 days - up to 30 days | 2 times the normal fees | 4 times the normal fees |

| More than 30 days - up to 60 days | 4 times the normal fees | 8 times the normal fees |

| More than 60 days - up to 90 days | 6 times the normal fees | 12 times the normal fees |

| More than 90 days - up to 180 days | 10 times the normal fees | 20 times the normal fees |

| More than 180 days – up to 360 days | 15 times the normal fees | 30 times the normal fees |

| More than 360 days | 15 times the normal fees + 10 rupees per day |

30 times the normal fees + 20 rupees per day |

* Small LLP- “Small limited liability partnership” means a limited

liability partnersip –

(i) The contribution of which, does not exceed `25 lakh or such higher

amount, not exceeding `5 crore, as may be prescribed; and

(ii) The turnover of which, as per the Statement of Accounts and Solvency

for the immediately preceding financial year, does not

exceed forty lakh rupees or such higher amount, not exceeding fifty crore

rupees, as may be prescribed; or

(iii) Which meets such other requirements as may be prescribed, and

fulfils such terms and conditions as may be prescribed –

section 2(1)(ta) of LLP Act, inserted vide LLP Amendment Act, 2021 w.e.f.

1-4-2022.

* all late fees will be charged along with the normal fees.

LLP FORM 11 STATEMENT OF ACCOUNTS AND SOLVENCY

Form 11 is an Annual return that is to be filled by all LLPs irrespective of

turnover during the year. Even when an LLP does not carry out any

operations or business during the financial year, Form 11 needs to be filed.

Apart from Basic information about Name, Address of LLP, details of Partners/

Designated Partners, other details that need to be declared are:

Total contribution by/to partners of the LLP.

Details of notices received towards Penalties imposed / compounding offenses

committed during the financial year.

Time: 60 days from end of the financial year.

Fees: The fees of the LLP form 3 depends on the total capital

contribution by the partners as below:

| CAPITAL CONTRIBUTION | FEES |

|---|---|

| Less than 1,00,000 | 50 |

| 1,00,001-5,00,000 | 100 |

| 5,00,001-10,00,000 | 150 |

| 10,00,001-25,00,000 | 200 |

| 25,00,001-1,00,00,000 | 400 |

| Above 1,00,00,000 | 600 |

* Late fees: The late fees depends on the delay in terms of no. of days in filling the form when 30 days’ time period has been lapsed.

| No. of days | Small LLP* | Other than small LLP |

|---|---|---|

| Within 15 days | 1 time the normal fees | 1 times the normal fees |

| More than 15 days - up to 30 days | 2 times the normal fees | 4 times the normal fees |

| More than 30 days - up to 60 days | 4 times the normal fees | 8 times the normal fees |

| More than 60 days - up to 90 days | 6 times the normal fees | 12 times the normal fees |

| More than 90 days - up to 180 days | 10 times the normal fees | 20 times the normal fees |

| More than 180 days – up to 360 days | 15 times the normal fees | 30 times the normal fees |

| More than 360 days | 25 times the normal fees | 50 times the normal fees |

* Small LLP- “Small limited liability partnership” means a limited

liability partnersip –

(i) The contribution of which, does not exceed `25 lakh or such higher

amount, not exceeding `5 crore, as may be prescribed; and

(ii) The turnover of which, as per the Statement of Accounts and Solvency

for the immediately preceding financial year, does not

exceed forty lakh rupees or such higher amount, not exceeding fifty crore

rupees, as may be prescribed; or

(iii) Which meets such other requirements as may be prescribed, and

fulfils such terms and conditions as may be prescribed –

section 2(1)(ta) of LLP Act, inserted vide LLP Amendment Act, 2021 w.e.f.

1-4-2022.

* all late fees will be charged along with the normal fees.

GST COMPLIANCES OF LLP

GSTR 1

Content:

* Details of outward supplies made to registered taxpayers (B2B supplies).

* Details of outward supplies made to unregistered taxpayers (B2C supplies)

where the invoice value exceeds Rs. 2.5 lakhs.

* Summary of exports and supplies made to SEZs.

* Details of debit and credit notes issued during the reporting period.

* Amendments to invoices or credit/debit notes issued in previous periods.

Due date:

* For Monthly Filers: 11th of the following month.

* For Quarterly Filers: 13th of the month following the end of the quarter.

Late Fees:

Late filing of GSTR-1 attracts a late fee of Rs. 50 per day (Rs. 20 for taxpayers having nil tax liability) subject to a maximum of Rs. 5,000.

GSTR 3B

Content:

* Details of outward supplies (sales) including both taxable and exempt

supplies.

* Summary of inward supplies (purchases) including imports and purchases liable

for reverse charge.

* Calculation of input tax credit (ITC) availed on purchases.

* Summary of tax liability including IGST, CGST, SGST/UTGST, and cess payable.

* Details of tax paid and any amount payable after adjusting the input tax

credit.

* Amendments to the previous month's return if required.

Due date:

The due date for filing GSTR-3B is typically the 20th of the following month. For example, the return for the month of January is due by February 20th.

Late Fees:

Failure to file GSTR-3B by the due date attracts a late fee of Rs. 50 per day (Rs. 20 for taxpayers with nil tax liability) up to a maximum of Rs. 5,000

GSTR 9

GSTR-9 is an annual return form that must be filed by registered GST taxpayers in India. It consolidates the information furnished in the monthly or quarterly GST returns (GSTR-1, GSTR-3B) during the financial year.

Types of GSTR-9 Forms

GSTR-9: For regular taxpayers under the GST.

GSTR-9A: For taxpayers opting for the GST Composition Scheme (This form

was phased out after FY 2019-20).

GSTR-9B: For e-commerce operators who are required to collect tax at

source under GST.

GSTR-9C: A reconciliation statement, essentially an audit form for

taxpayers whose annual turnover exceeds a specified limit. It is to be filed

along with GSTR-9 and audited by a certified professional.

Due Date: December 31 st of the next financial year.

Late fees: A late fee of INR 200 per day (INR 100 under CGST and INR 100

under SGST) is levied for delay in filing GSTR-9. However,

there's a catch the late fee is subject to a maximum of 0.25% of the

taxpayer's total turnover in the relevant state or union territory.

INCOME TAX COMPLIANCE

ITR 5

There are 7 types of ITRs but for LLPs ITR 5 is applicable as per Income Tax Act 1961.

Who Should File ITR-5?

- Partnerships (not opting for the presumptive taxation scheme under section 44AD, 44ADA, or 44AE)

- Limited Liability Partnerships (LLPs)

- Association of Persons (AOPs)

- Body of Individuals (BOIs)

- Artificial Judicial Persons

- Business trust

- Investment fund as per section 115UB

- Co-operative Societies

Key Components of ITR-5

General Information: Basic details of the entity, including name, PAN

(Permanent Account Number), address, and status.

Gross Total Income: From the five heads of income under the Income Tax

Act.

Deductions and Exempt Income: Details of deductions claimed under various

sections and exempt income.

Total Income: Calculated after deducting the eligible deductions from the

Gross Total Income.

Tax Computation: Computation of tax payable on the total income.

Details of Taxes Paid: Includes advance tax, self-assessment tax

payments, TDS (Tax Deducted at Source), and TCS (Tax Collected at

Source).

Other Information: Depending on the specific case, this might include

details of foreign assets, information about tax-saving investments,

etc.

Audit Information: Details about the audit, if applicable, under sections

44AB, 92E, or others.

Filing Due Dates

The due dates for filing ITR-5 can vary depending on the entity's circumstances and any extensions provided by the Income Tax Department. Generally, for entities requiring audit, the due date is usually October 31st of the assessment year. For those not requiring audit, the due date is typically July 31st of the assessment year. However, it's important to check for any extensions or changes in due dates announced by the authorities.

LATE FEES

Late Filing Fees: If the taxpayer files the ITR-5 after the due date

specified by the Income Tax Department, a late filing fee may be

applicable. The late filing fee for filing ITR after the due date but on or

before December 31 of the relevant assessment year (AY) is Rs.

5,000. However, if the return is filed after December 31 but before March 31 of

the AY, the late filing fee is Rs. 10,000.

Lower Fees for Small Taxpayers: For taxpayers with total income not

exceeding Rs. 5 lakhs, the late filing fee is capped at Rs. 1,000.

TDS COMPLIANCE

Tax Deducted at Source (TDS) is a method where tax is deducted from income (like salaries or interest payments) at the point of generation and directly remitted to the government. It ensures advance collection of taxes and reduces tax evasion, easing the tax payment process for the recipient.

TDS Deduction Responsibility

LLPs who are having a valid TAN are required to deduct TDS on certain payments made by them, such as:

- Salary to employees (Section 192)

- Interest to residents exceeding specified limits (Section 194A)

- Payments to contractors or sub-contractors (Section 194C)

- Rent payments exceeding specified limits (Section 194I)

- Professional or technical service fees exceeding specified limits (Section 194J)

- Commission or brokerage exceeding specified limits (Section 194H)

- Other payments specified under the Income Tax Act

The rates and thresholds for TDS deduction vary for each category of payment and are specified in the relevant sections of the Income Tax Act.

TDS Returns

Form 24Q: This return is filed for TDS deducted on salaries.

Form 26Q: Filed for TDS deducted on all payments other than salaries.

Form 27Q: Used for TDS deducted on payments made to non-residents other

than salary.

Form 27EQ: Filed for TDS deducted on tax collected at source.

DUE DATES OF TDS

TDS Deduction Due Date: Tax must be deducted at source at the time of

making specified payments or credit to the payee's account,

whichever is earlier. The due date for TDS deduction is typically at the time of

payment or credit, as per the provisions of the Income Tax Act.

TDS Deposit Due Date: After deducting TDS, the deductor is required to

deposit the tax amount with the government. The due date for

depositing TDS is generally the 7th of the following month, except for March,

where it's typically April 30th.

TDS Return Due Dates: The deductor must file quarterly TDS returns

providing details of TDS deducted and deposited. The due dates for

filing TDS returns are as follows:

| Quarter | Months | Dates |

|---|---|---|

| Q1 | April-June | July 31 |

| Q2 | July-September | October 31 |

| Q3 | October-December | January 31 |

| Q4 | January-march | May 31 |

ESIC (Employees' State Insurance Corporation) and EPFO (Employees' Provident Fund Organization) are statutory bodies in India responsible for implementing social security schemes for employees. While both ESIC and EPFO primarily apply to companies and establishments with a certain threshold of employees, including LLPs, their applicability and compliance requirements may vary.

ESIC COMPLIANCE

ESIC stands for the Employees' State Insurance Corporation, which is a social security organization in India established under the Employees' State Insurance Act, 1948. ESIC provides a range of benefits to employees, including medical, cash, maternity, disability, and dependent benefits, to ensure their welfare and protect them against unforeseen contingencies such as sickness, maternity, temporary or permanent disablement, and death due to employment injury.

ESIC Compliance for LLPs:

Applicability: If an LLP has more than 10 employees (in some states, the

threshold is 20 employees), it is required to comply with ESIC

regulations.

Employee Contribution: Employees and employers contribute a percentage of

the employee's salary towards ESIC. The current

contribution rates are 1.75% of the employee's salary by the employee and

4.75% by the employer, totaling 6.5%.

Registration: LLPs meeting the employee threshold must register with ESIC

within 15 days of becoming eligible for registration.

Monthly Returns: LLPs must file monthly returns with ESIC, providing

details of the wages paid and contributions made by both the

employer and employee.

Payment of Contributions: Contributions must be deposited with ESIC

within 21 days from the end of the month in which the wages were

paid.

What if ESIC Returns not filled on time?

Penalties and Late Fees: Failure to file ESIC returns within the

prescribed due dates may attract penalties and late fees. The exact amount

of penalties may vary based on the duration of delay and the provisions of the

Employees' State Insurance Act, 1948.

Legal Consequences: Non-compliance with ESIC regulations could result in

legal action by the Employees' State Insurance Corporation

(ESIC). This may include notices, inspections, and other enforcement measures by

ESIC authorities.

Negative Impact on Reputation: Failure to comply with ESIC regulations

reflects poorly on the employer's reputation and credibility. It may

also lead to dissatisfaction among employees, affecting morale and productivity.

Accumulation of Dues: Delay in filing ESIC returns may result in the

accumulation of dues and liabilities, including contributions, interest,

and penalties, which could pose financial challenges for the employer.

ESI Returns Dues date

For the Period April to September (First Half of the Financial Year):

The due date for filing ESIC returns for this period is generally on or before

November 12th of the same financial year.

For the Period October to March (Second Half of the Financial Year):

The due date for filing ESIC returns for this period is generally on or before

May 12th of the subsequent financial year.

EPFO COMPLIANCE

EPF stands for Employees' Provident Fund, which is a social security and retirement savings scheme in India. It is regulated and managed by the Employees' Provident Fund Organization (EPFO), a statutory body under the Ministry of Labour and Employment, Government of India. EPF is a compulsory savings scheme for employees in certain sectors and industries.

EPFO COMPLIANCE for LLPs:

Applicability: LLPs employing 20 or more employees are subject to EPF

regulations. However, LLPs with fewer than 20 employees can

voluntarily register with EPFO.

Employee Contribution: Both employees and employers contribute a

percentage of the employee's salary towards the Employees'

Provident Fund (EPF). The current contribution rates are 12% of the

employee's salary by the employee and 12% by the employer.

Registration: LLPs meeting the employee threshold must register with EPFO

and obtain a unique Establishment Code Number.

Monthly Returns: LLPs must file monthly returns with EPFO, providing

details of the wages paid and contributions made by both the

employer and employee.

Payment of Contributions: Contributions must be deposited with EPFO

within 15 days from the end of the month in which the wages were

paid.

What if EPF Returns not filled on time?

Penalties and Late Fees: Failure to file EPF returns within the

prescribed due dates may attract penalties and late fees. The exact amount

of penalties may vary based on the duration of delay and the provisions of the

Employees' Provident Fund and Miscellaneous Provisions Act,

1952.

Legal Consequences: Non-compliance with EPF regulations could result in

legal action by the Employees' Provident Fund Organization

(EPFO). This may include notices, inspections, and other enforcement measures by

EPFO authorities.

Loss of Trust and Reputation: Failure to comply with EPF regulations

reflects poorly on the employer's reputation and credibility. It may

erode the trust and confidence of employees and stakeholders, potentially

affecting the employer's brand image and business prospects.

Accumulation of Dues: Delay in filing EPF returns may result in the

accumulation of dues and liabilities, including contributions, interest,

and penalties, which could pose financial challenges for the employer.

EPF Return Due Date: 15 th of every next month.

Late Fees:

For Employers with up to 5 Employees: No late fee is applicable for

employers with up to 5 employees.

For Employers with 6 or More Employees: For employers with 6 or more

employees, the late fee for delayed filing of EPF returns is ₹100

per day of delay for each month of default.

ACCOUNTING

Accounting is the process of recording, summarizing, analyzing, and reporting

financial transactions of a business or organization. It involves

systematically recording financial data to produce financial statements and

reports that provide insights into the financial health and

performance of the entity.

Here we prepare the accounts of the company as per the Bank statement, Sale and

Purchases of the company shown in GST portal for

preparation of the balance sheet, P&L and other financial accounts.